Make The Most Of The Rest Of Your Life!

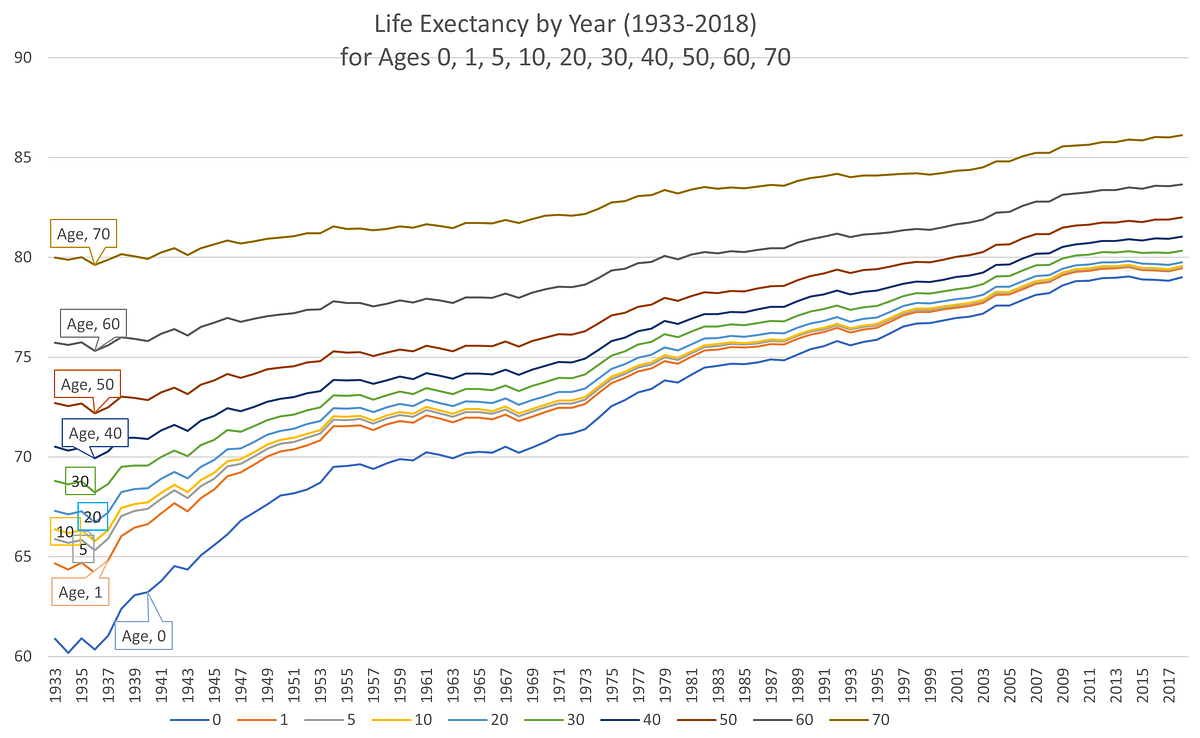

Over our lifetimes the average life expectancy if you’re 65 has increased about 10 years, from the mid-70s to the mid-80s. That’s the average, so some of us will live far longer. My Dad, who was born in 2015, lived to over 103!

Check out the chart below, particularly the lines for ages 70, 60, and 50. And there’s even more good news. Look at the big increases in infant and child expectancy (ages 0, 1, 5, and 10). We’re all increasingly more likely to live longer and healthier lives.

Why is this happening? Better healthcare, higher awareness of how to stay vital longer, and an overall healthier focus on wellbeing all contribute to these longevity gains.

Misdirection

Here’s where the financial advisory industry jumps in. They’ve worked hard to strike fear into your heart and get you single-mindedly focused on your “number.” And more recently, the focus has been shifting to personalized investing with customized portfolios tailored to your individualized goals and tax situation.

What’s the reality vs. magical thinking? 22% of U.S. managed funds outperformed the S&P 500 benchmark over 5 years. That means your chances are 1 in 5 that you’d have picked a managed fund that outperformed. It also means that 4 out of 5 times you’d have done worse. So, caveat emptor, let the buyer beware!

Nevertheless, you can systematically figure this out, either by yourself or by finding some help. Just use an approach based on pragmatic principles, rather than hope and hype. To help you get started, check out my Retire With Power™ Free Report. It shows you a way to create a better strategy to retire comfortably.

The Bigger Game

But there’s an even bigger and more critical risk than your “number.” It’s the risk of whether you’re making the very most out of the rest of your life and milking every juicy delicious drop out of each moment.

Listen to what Charles Rotblut, vice president of American Association of Individual Investors and editor of the AAII Journal, has to say:

“Let’s start with the decision about when to retire…What is agreed upon is the need to have a plan for staying socially and cognitively engaged as well as physically active…[I]t’s critical for those transitioning into retirement to also have a strategy for how they’re going to fill up their free time.”

CHARLES ROTBLUT, AMERICAN ASSOCIATION OF INDIVIDUAL INVESTORS

The AAII is a nonprofit whose purpose is to educate individual investors regarding financial planning. It’s notable that even they consider the bigger game to be having a plan for enjoying your retirement.

What are you going to do with all the time on your hands? Are you currently fully using your skills, talent, creativity, and energy? Do you want or need to coordinate your goals with those of your spouse?

An Opportunity

Now’s the time to do some important work:

- What lifestyle do you want to have?

- What’s precious that you have to protect?

- How can you feel a genuine passion to be working on projects you love?

- What do you still want to do in your lifetime?

Answering these questions will help you get tuned in to what’s really you. And you can use it to help you find real clear common ground with your partner.

Take the next step. Get into action now and start making it happen.

More Information

How do you systematically tackle those questions and challenges so you can create an amazing retirement? I’ve created the Retirement Game Plan, based on the pragmatic steps I’ve taken to create a retirement I love. Check it out and see if those steps could help you too.

Thanks for reading!

Eric

©2021 ExploringRetirement.club. All Rights Reserved.